Chocolate rush: world cocoa prices soar, the price of chocolate is set to rise

You’ve probably heard about it: in recent months we’ve seen an unprecedented rise in the international price of cocoa. The price has set a series of all-time records, and it looks like it’s not going to stop there. We’re going to make a modest attempt to explain the issues surrounding this exceptional situation and its impact on the price of chocolate.

-

-

-

- COCOA PRICES SOAR EVER HIGHER

- Why are cocoa prices rising so much?

- Why is global cocoa production falling?

- Will cocoa prices continue to rise or eventually fall?

- IS THIS SITUATION OF RISING COCOA PRICES PROFITABLE FOR PRODUCERS?

- Producers in Côte d’Ivoire and Ghana not benifiting from higher prices

- Cocoa producers in SOuth American benefit from higher prices

- How are producer cooperatives coping with this rise in cocoa prices?

- RISING COCOA PRICES AND THE CLIMATE: WHAT’S THE SITUATION IN THE KAOKA COCOA PROGRAMS?

- In our cocoa program in Ecuador: cocoa production impacted by El Niño and agressive competition

- In our cocoa program in Peru: a promising harvest

- In our cocoa program in São Tomé: the season has not yet started

- Rising prices: an opportunity for Kaoka’s partner producers

- COCOA PRICES SOAR EVER HIGHER

- WILL CHOCOLATE MAKERS AND OTHER MANUFACTURERS FIND IT DIFFICULT TO SOURCE COCOA AND CHOCOLATE?

- CHOCOLATE PRICES: INCREASES AND VARIATIONS BETWEEN BRANDS

- Why haven’t chocolate prices gone up yet? Will the price of chocolate go up soon?

- Why are Kaoka chocolate prices going up?

- What practices can we expect to see to bring down the price of chocolate?

- WE NEED TO SUPPORT THE FARMING WORLD TO MAKE CHOCOLATE A PERMANENT PART OF OUR LIVES

- The end of ivorian cocoa supremacy?

- Faced with climate change, Kaoka provides practical solutions for producer organisations

- A collection of cocoas to meet the climate challenge

- Combat deforestation to slow the effects of climate change

-

-

Cocoa prices soar ever higher

Why are we talking about the price of cocoa and what impact does it have on the price of chocolate? Like many commodities, the price of cocoa, and therefore chocolate, is indexed to stock market prices. This is the price at which cocoa beans are traded on international markets. This price is determined by world supply and demand for cocoa. It is affected by various economic, social and environmental factors, as well as by speculation on the financial markets.

À noter African cocoa is traded on the basis of the London Stock Exchange price and Latin American cocoa on the basis of the New York Stock Exchange price.

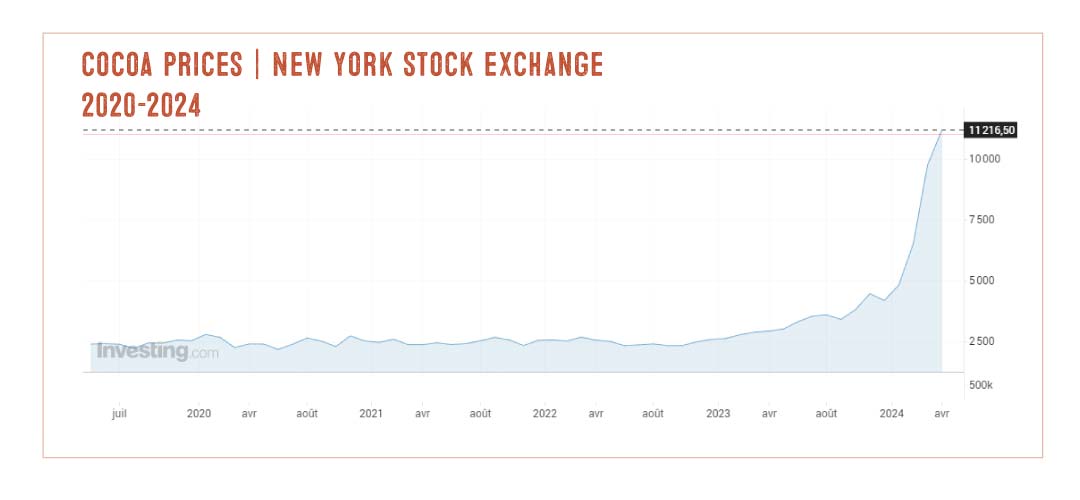

The last record was set in 1977, when the price was $5,300/tonne. It was beaten in February 2024. Barely two months later, and defying all projections, the price of cocoa doubled to $10,600 a tonne (15 April 2024). The following week, it reached $11,479. In one year, the price of cocoa has risen by 268%.

We are therefore witnessing an absolutely exceptional situation that has never been seen before in the history of chocolate.

Why are cocoa prices rising so much?

Various factors can explain the spectacular rise in the price of cocoa: an imbalance between supply and demand, a fall in world stocks and, consequently, a speculative trend exaggerating the phenomenon.

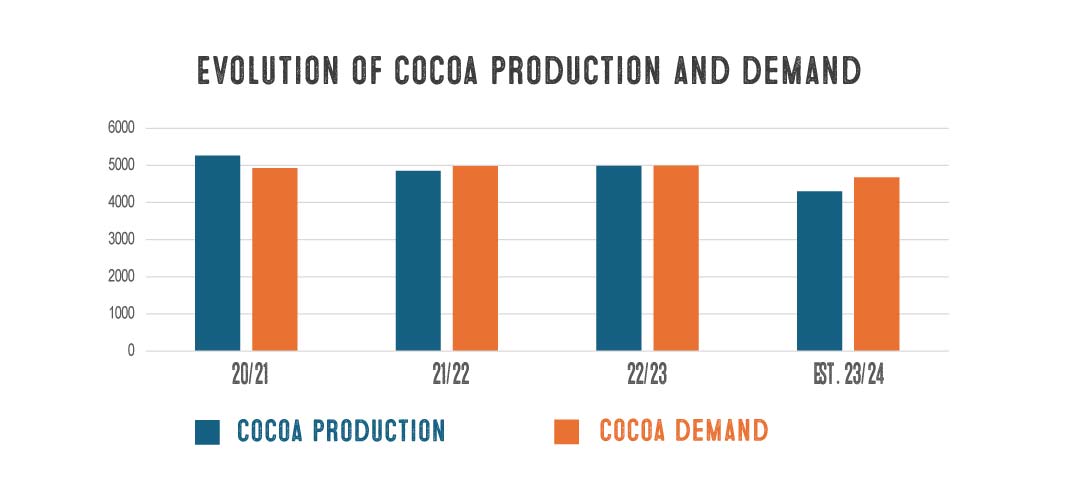

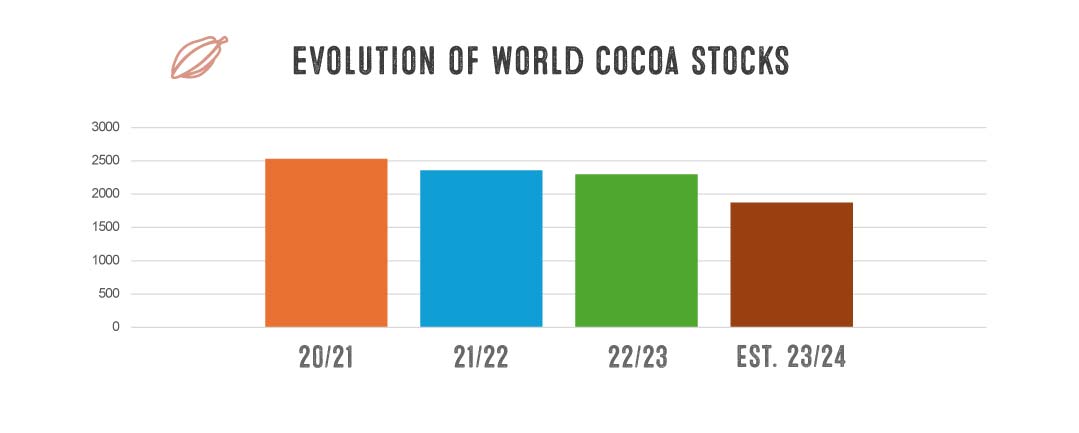

So why this imbalance between supply and demand? Demand for cocoa and chocolate, which comes mainly from Europe and North America, is relatively stable, if not rising slightly. However, in recent years, cocoa production has been falling and is now below demand (cocoa/chocolate consumption), resulting in a 3rd consecutive year of deficit. In 2024, this gap between supply and demand is expected to reach a volume of 423,000 tonnes of cocoa (i.e. around 8% of usual world production). So it looks like there won’t be enough for everyone!

Until now, this raw materials deficit has been offset by existing stocks. However, this 3rd year of deficit has led to a significant fall in world stocks. These stocks are necessary for the smooth running of production in the chocolate industry. And it is this fall in stocks that is tending to panic the financial markets.

Why is global cocoa production falling?

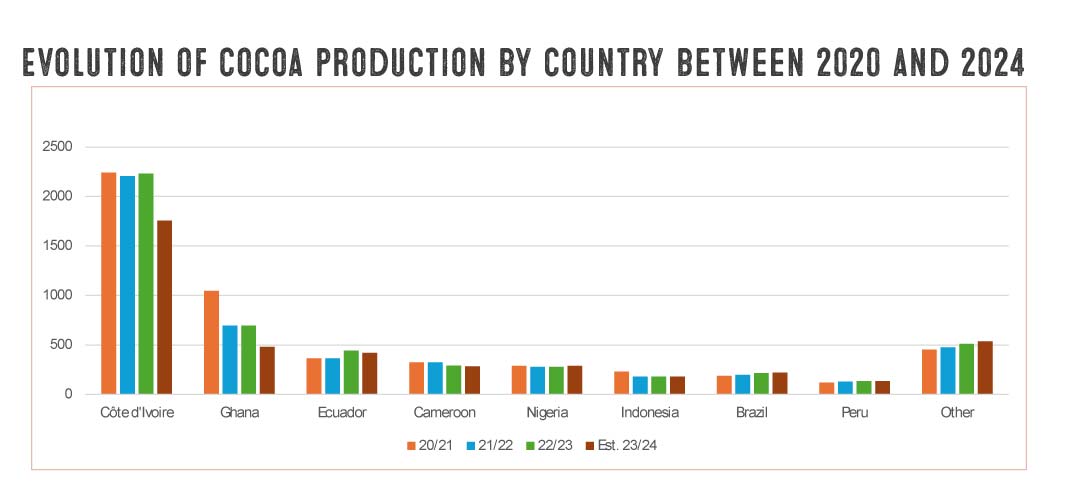

There has been one poor harvest year after another, with the 2023/2024 season being the most significant (a season runs from 1 October to 30 September of the following year). Côte d’Ivoire and Ghana account for around 60% of the world’s cocoa production. Harvests are expected to fall by 20% in Côte d’Ivoire and 30% in Ghana.

The El Niño phenomenon (still ongoing) coupled with global warming has had a major impact on Africa. In July 2023, Côte d’Ivoire experienced very heavy rainfall. In some regions, the rainfall recorded since the beginning of 2023 was higher than the average for the last 30 years. This rain has caused flowers to drop as soon as they have formed, and fungal diseases such as moniliosis and brown rot to develop strongly. It is important to note that in some areas, plantations had already been weakened for several years by a viral disease, swollen shoot (a highly contagious disease transmitted by mealybugs).

This was compounded by a long period of drought. Cocoa trees need water to grow and produce their fruit. In most cocoa-producing countries, cocoa is grown on a pioneering front: forests (often already degraded by other industries) are cut down to plant new crops. This slash-and-burn agriculture, which tends to degrade the soil, is a form of extensive farming. Once the soil is too degraded and has a negative impact on yields, the crop is planted on new cleared land, and so on. Cocoa is therefore mainly grown as a monoculture without any shade, making the cocoa trees even more vulnerable to drought and disease.

The combined effect of this method of cultivation, disease and weather conditions has therefore severely affected cocoa harvests for the 2023/2024 season.

Will cocoa prices continue to rise or eventually fall?

The economic and financial ecosystem surrounding cocoa is complex, which is why no one is currently in a position to predict whether the price of cocoa will continue to rise, stabilise at this level or fall and stabilise at a higher level than before.

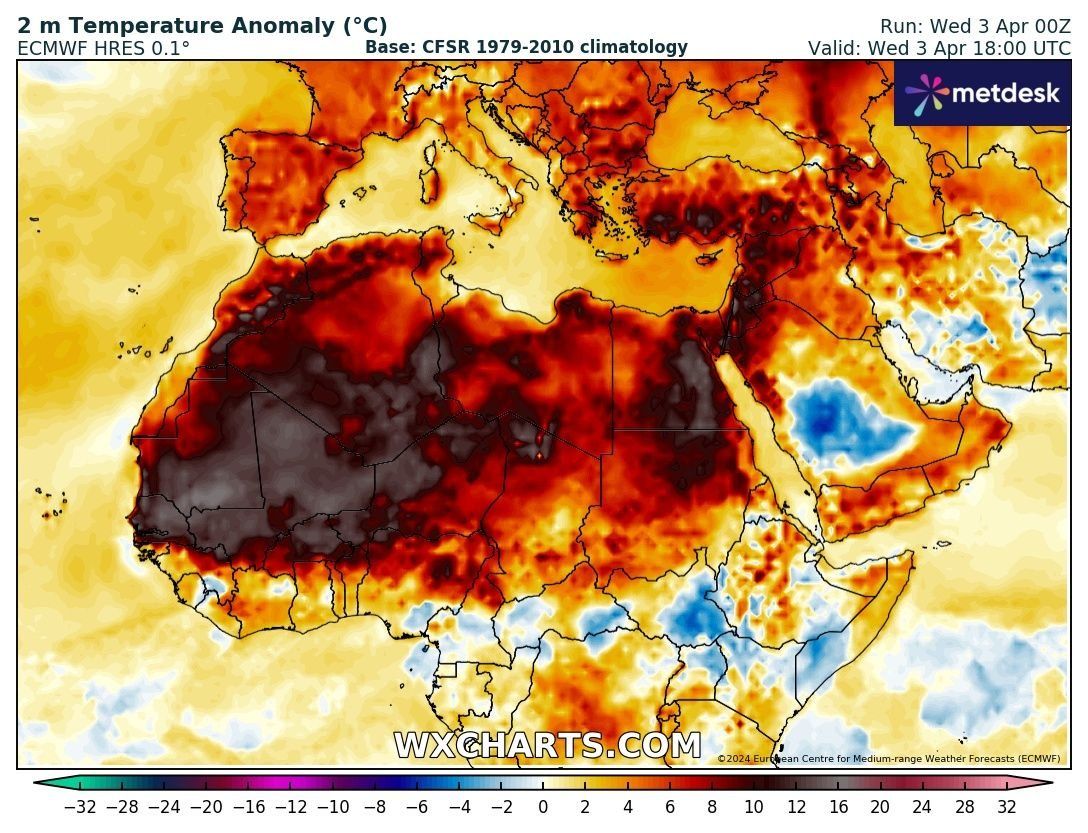

This will depend on cocoa production and therefore on weather conditions. In many cocoa-producing countries in West Africa and South America, temperatures are abnormally high. After a particularly hot February and March, the northern part of the African continent has been hit by record heat waves.

If human living conditions have deteriorated considerably, so too have those of the trees, which are enduring severe water stress, impacting their productive capacity. This situation is likely to persist over the coming months. Although it is still too early to draw up a trend for the 2024/2025 harvest, current weather conditions are not encouraging.

However, given the rise in chocolate prices, it is highly likely that sales volumes will fall significantly. Following this fall in demand, the market is likely to rebalance. Only time will tell…

Is this situation of rising cocoa prices profitable for producers?

Generally speaking, producers of raw materials whose prices are indexed to stock market prices are dependent on price volatility. They are paid according to world prices, are subject to the effects of speculation and are exposed to variations that are independent of their agricultural realities. Producers are located in very different countries, sometimes far apart, so they do not share the same economic, political or climatic context.

Stock market price vs. price paid to the producer The stock market price does not represent the price received by the producer for his cocoa. The price corresponds to the price at which cocoa is traded internationally by exporters, wholesalers and traders. As a result, the situation for producers is highly variable and depends on how the sector is structured in each country.

Producers in Côte d’Ivoire and Ghana not benefiting from higher prices

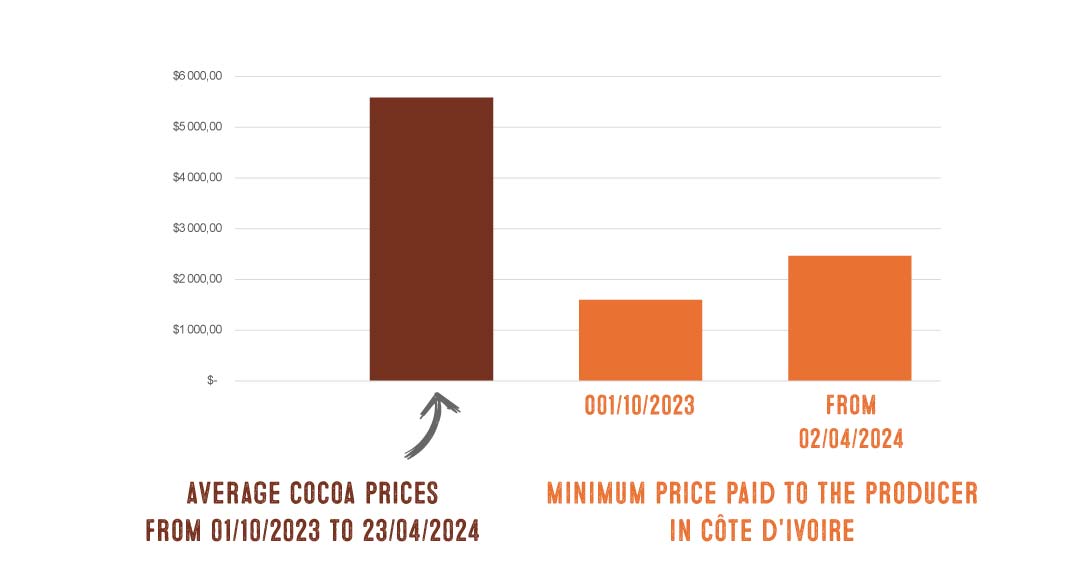

In Côte d’Ivoire and Ghana, the world’s leading cocoa producers, prices are administered, i.e. they are regulated to protect cocoa farmers and the country’s economy. Cocoa accounts for 14% of national GDP and provides an income for 20% of the Ivorian population. To protect farmers from fluctuations in world prices, a fund has been set up to absorb them and offer farmers a stable price over the year. Each year, a minimum purchase price is set on 1 October for the duration of the season. Intermediaries are required to respect at least this price when they buy cocoa “in the field” from producers.

In Côte d’Ivoire, the floor price was set at the start of the 2023/2024 season at 1,000 CFA francs per kilo (€1.52 per kilo, or €1,520 per tonne). Faced with soaring prices and union demands, the authorities were forced to raise the price to 1,500 CFA francs (€2.30 per kilo, or €2,300 per tonne) from 02 April 2024.

While cocoa prices are rising above $10,000/tonne (€9,400/tonne), Ivorian cocoa farmers are not currently benefiting from this increase. Especially since, as we saw earlier, even if they are benefiting from a better price than at the start of the campaign, their harvests have fallen considerably. This price increase is far from sufficient to compensate for the current drop in volume. The families of producers in both Côte d’Ivoire and Ghana are facing very difficult times.

Even against this backdrop of rising raw material prices, Fair Trade remains essential to support producers.

Cocoa producers in South America benefit from higher prices

In South American countries, markets have been liberalised. Producers are more attentive, and in this context of lack of supply, increases are better reflected in purchase prices.

In Ecuador, for example, purchase prices from producers are currently almost equivalent to the stock market price.

How are producer cooperatives coping with this rise in cocoa prices?

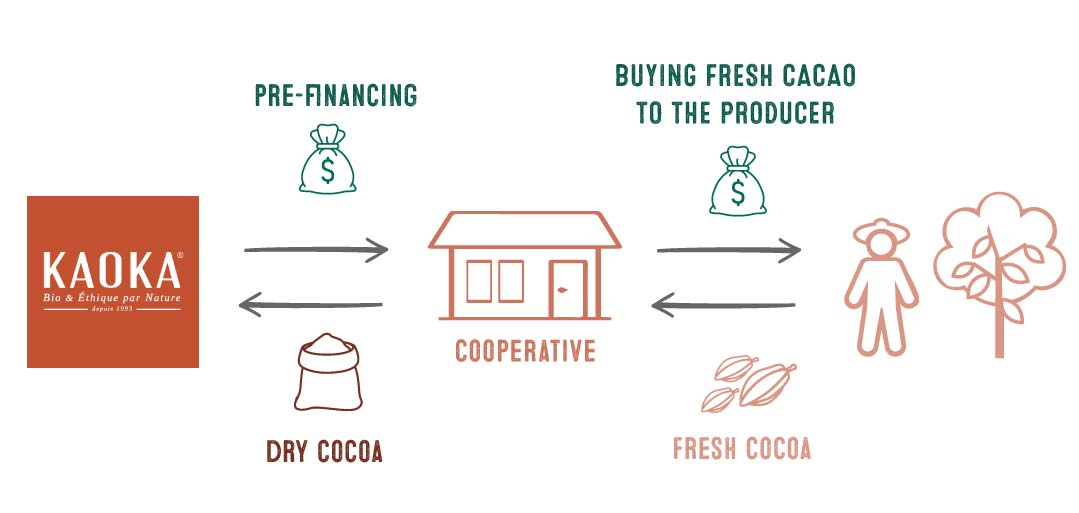

The current situation is particularly complicated for cooperatives. Faced with soaring prices, cooperatives need to have the cash flow they need to buy cocoa from their producer members. With cocoa beans being bought at a price 3 to 4 times higher than before, cash requirements are particularly high.

What’s more, the shortage of raw materials on the market is making the buying practices of local intermediaries more aggressive. It is therefore difficult for cooperatives, which have to bear the costs of certification, traceability, development projects, etc., to remain competitive and continue to source cocoa.

This situation could put many cooperatives at risk. That’s why it’s vital to provide support for the chocolate industry.

Rising cocoa prices and the climate: what’s the situation in the Kaoka cocoa programs?

At Kaoka, we have chosen to work with a limited number of origins. We felt that building sustainable fair trade supply chains required a high level of commitment in terms of human time and financial resources. At Kaoka, we have therefore decided to prioritise quality over the quantity of origins on offer. In this way, we can respond with dedicated projects to each of the issues present in our supply chains (ageing plantations, lack of soil fertility, etc.).

To offer you top quality cocoa, we have high standards and, in return, we provide very strong guarantees to producer organisations:

- 100% of harvests purchased each year to ensure a long-term outlet

- at a price higher than the market price

- 100% of purchases pre-financed to the cooperative.

Despite the spectacular rise in prices, we are maintaining our commitments to the cooperatives.

What does this mean? Until recently, when cocoa prices were relatively stable, Kaoka was able to plan the development of its supply chains in line with its commercial outlets. Over the last few months, the purchase prices of cocoa from our production chains have risen considerably, and even though we are seeing a drop in production volumes, the cash flow requirements to pre-finance the harvests are becoming more and more substantial.

In our cocoa program in Ecuador: cocoa production impacted by El Niño and aggressive competition

As a result of the El Niño phenomenon, Ecuador, which shares its west coast with the Pacific, has suffered heavy rainfall, affecting its harvests. The buying practices of intermediaries are very aggressive, and follow cocoa prices almost instantaneously. The extreme volatility of cocoa prices on any given day complicates the purchasing conditions for our partner cooperative. Over the course of a single day, the price can vary by as much as $1,000, which is quite considerable. As with every problem we have encountered, we have worked with our partner cooperative to find solutions and provide it with the tools it needs to be reactive and competitive in the face of local intermediaries.

Thanks to this support, producers will be able to benefit from the best prices and we’ll be helping our partner cooperative to get through this unprecedented period. As for Kaoka, we will be able to continue to supply ourselves with Ecuadorian cocoa to make all our chocolates from Ecuador.

In our cocoa program in Peru: a promising harvest

Our cocoa program in Peru, located in the Amazon region on the other side of the Andes, has been less affected by El Niño. However, it is important to note that the growers in our Peruvian cooperative have experienced very hot weather in recent months, accompanied by an unusual lack of rain. We are seeing recurring periods of severe drought in the Amazon. The lack of rain could ultimately have a negative impact on cocoa harvests.

In our cocoa program in São Tomé: the season has not yet started

Like West Africa, São Tomé, which lies off the coast of Gabon, is suffering from very hot weather. While the small harvest has proved satisfactory, it is still too early to say anything about the large harvest (which runs from October to December, as in Côte d’Ivoire).

Rising prices: an opportunity for Kaoka’s partner producers

Working as closely as possible with the cooperatives, Kaoka’s partner producers are benefiting positively from this rise in prices. Thanks to this surplus, they will be able to invest more in the redensification of their plantations (planting more cocoa trees in the empty spaces) and in the renovation of their plantations (grafting their ageing trees that have become unproductive). With this increase, growing cocoa will become even more attractive.

We are encouraging them to prepare themselves as well as possible for possible future heatwaves, in particular through agroforestry.

In the Kaoka cocoa programs, we support fruitful and remunerative peasant farming based on sustainable and efficient methods. Over the last 20 years or so, we have carried out extensive renovation and training programmes to enable producers to improve their harvests and thus their incomes.

Will chocolate makers and other manufacturers find it difficult to source cocoa and chocolate?

As we mentioned earlier, the shortfall is likely to be 423,000 t of cocoa, and stocks are getting lower and lower. It is therefore logical to think that some operators will be unable or unwilling to obtain normal supplies because the cost of the raw material is too high.

Another point to note: at the end of 2024, the European regulation against imported deforestation is due to come into force. As players will have to prove that their goods are deforestation-free, this new regulatory constraint could put the brakes on some imports into the European Union.

Chocolate prices: increases and variations between brands

Why haven’t chocolate prices gone up yet? Will the price of chocolate go up soon?

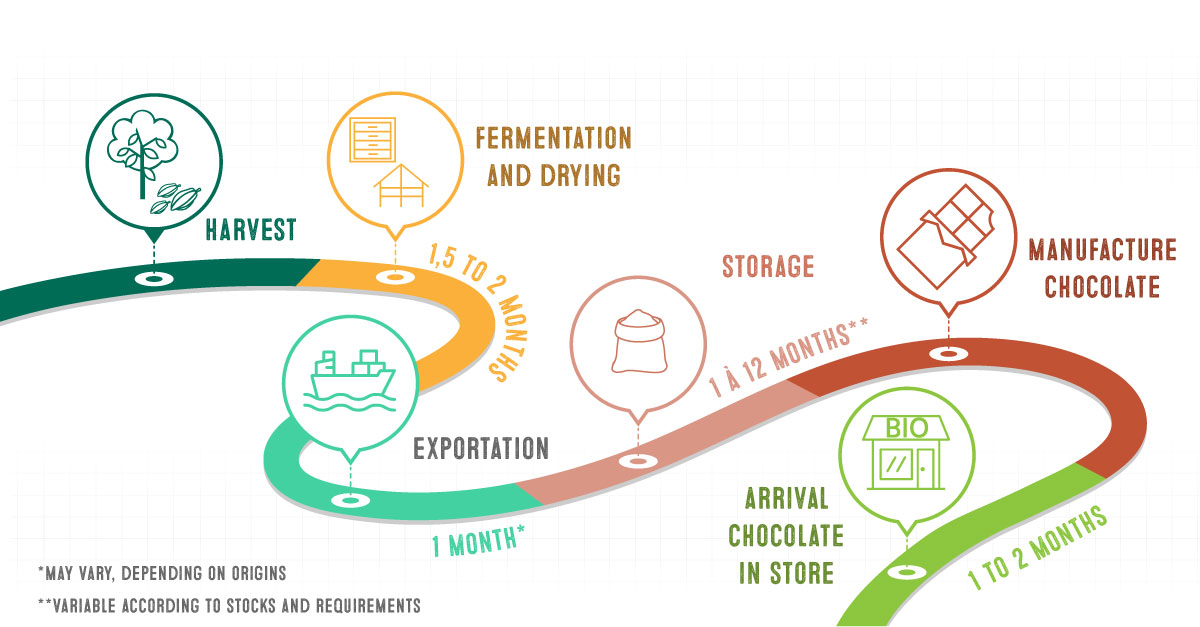

For some months now, you’ve been hearing about spectacular rises in the price of cocoa, but you haven’t seen any increases in the shops. Chocolate is a processed product that requires a number of stages from the raw material. Several months go by between harvesting, post-harvest processing (fermentation and drying), export, storage, processing, chocolate making and then putting it on the shelves.

While the rise in the price of chocolate seems inevitable, different criteria and practices can explain the time lag in price adjustments made by brands.

VARIABLE STOCK LEVELS OF RAW MATERIALS AND FINISHED PRODUCTS

The chocolates that have been on shop shelves up until now have been made from cocoa that was generally bought at the price before the hikes (i.e. around $2,000/tonne). However, stocks of raw materials and finished products will start to run out in the coming months. The chocolates that are soon to hit the market will be made with ingredients whose cost has risen by an average of 143% since October 2023. Companies in the chocolate sector will eventually be forced to pass on these rising costs in order to maintain their business model.

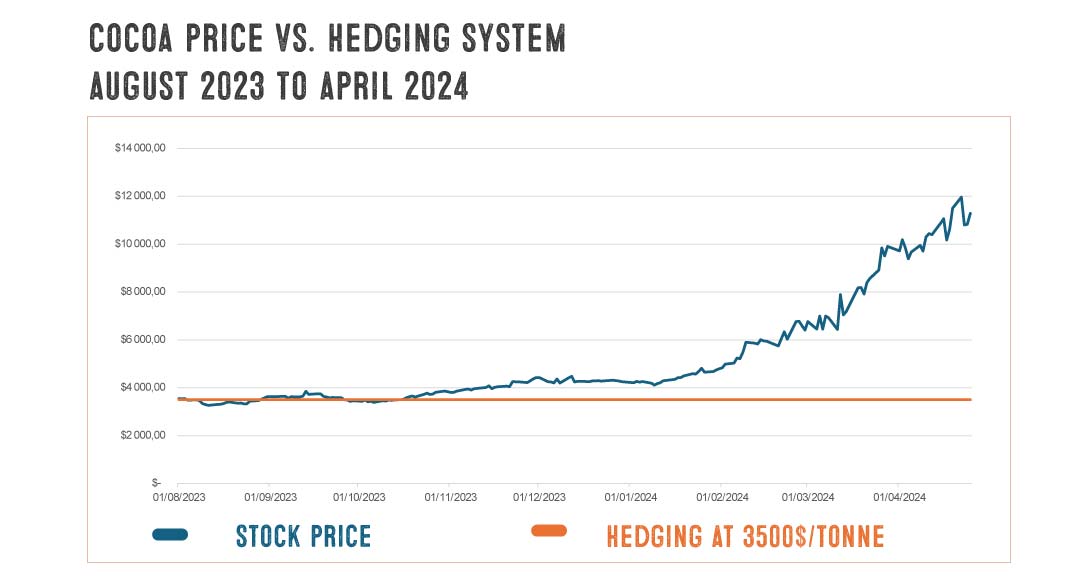

HEDGING MECHANISMS: RETREAT BEFORE LEAPING?

To protect themselves from stock market fluctuations, some players sign forward contracts with a fixed price for their supplies. This means that they commit to buying a set volume at a set price over a set period. If the stock market fluctuates downwards, they lose out: they buy a raw material at a higher price than the market price. If the stock market rises, they are ‘winners’: they buy a raw material at a lower price than the market price. In general, these contracts run from a few months to a year. Those who have hedged for a year will be able to ‘hold out’ longer than other players who have not hedged or who have hedged for a shorter period.

These players, who are covered for 2024, are hoping that the price level will return to ‘normal’ by September (the start of the period for budget definitions). This is a risky gamble, because if the price remains at this level, the increase they will have to apply will be much greater.

This Monopoly-like system is likely to penalise many companies, particularly those with cocoa program commitments.

DIFFERENT MARGIN POLICIES

Depending on their margin policies to date, some chocolate brands will be better able to absorb cost increases than others. Brands with a high-end positioning generally operate with a high gross margin and are better able to limit increases when they occur.

When Kaoka was created, its founder André Deberdt wanted to make his chocolate accessible to as many people as possible. As a result, we have always operated with limited margins. We are therefore more sensitive to increases in the cost of raw materials.

Multi-product brands, i.e. brands that offer products in different categories (chocolates, teas, biscuits, plant-based milks, yoghurts, etc.), can choose to offset this increase by spreading it across products that benefit from more comfortable margins. The increase in the price of various products is diluted in the eyes of the consumer and the brand maintains its margin percentage.

Specialist brands cannot use this mechanism and are more exposed if the price of their main raw material rises.

These different mechanisms do not reflect the economic reality of the market and create distortions in consumer perception.

Why are Kaoka chocolates going up?

At Kaoka, we don’t operate like most chocolate companies. We have strong commitments to producer organisations. At Kaoka, we buy cocoa continuously throughout the year from our partner cooperatives. When one of our partner producers arrives with his fresh cocoa, we buy 100% from him, regardless of the price level. As a result, we are directly impacted by stock market rises.

This is our vision of fair trade and we accept the circumstances. Because our commitments are constant and we operate on a reasonable margin, we are forced to pass on cocoa price rises and increase the price of our chocolates.

The increase in our prices is proof that our producer partners are benefiting from this exceptional situation and that their cocoa is being bought at the best price.

In conclusion, this increase in chocolate prices will vary from one brand to another, depending on existing stocks, coverage levels, commitments to producer cooperatives and margin policies.

It would be useful to look at the real practices of players who do not increase the price of their chocolate, or do so only slightly.

What practices can we expect to see to bring down the price of chocolate?

To cope with this exceptional increase in the cost of raw materials and avoid the price being too high, certain practices are emerging.

SHRINKFLATION

This practice has already been criticised by consumer associations for its lack of transparency: “shrinkflation”, which consists of discreetly reducing the weight of products without reducing the price or even increasing it slightly.

A bar of chocolate traditionally weighs 100g. To reduce the cost of the bar, many brands do not hesitate to reduce the weight of the product to 80g, for example. This is why we encourage consumers to always compare the price per kilo to help them make their choice on the shelf.

REPLACING COCOA BUTTER

Another practice would be to replace some of the particularly expensive cocoa butter with another less expensive vegetable fat (shea, palm, etc). According to the regulations, the vegetable fats authorised for use in chocolate production are: illipe, palm oil, sal, shea, kogum gurgi and mango kernels. The content of these vegetable fats must not exceed 5% of the weight of the chocolate.

LOWERING THE COCOA CONTENT AND INCREASING THE SUGAR CONTENT

Another method would be to lower the percentage of cocoa in chocolate. This would mean increasing the sugar content and therefore reducing the nutritional quality of the products.

Worth noting Milk chocolate naturally contains less cocoa, but its price is often higher than that of dark chocolate because the VAT rates applied are different. Milk chocolate is taxed at 20% whereas dark chocolate is taxed at 5%.

At Kaoka, we continue to guarantee the highest quality for our chocolates, with an authentic taste thanks to traced cocoa, zero deforestation and fair remuneration for producers.

We need to support the farming world to make chocolate a permanent part of our lives

This unprecedented surge in cocoa prices should be a wake-up call to the consequences of climate change. It reminds us that our food depends on weather conditions and that our economy is based on physical elements. In a context of disrupted climatic events, shortages could recur and intensify. These shortages lead to sharp price rises, making certain foodstuffs inaccessible to economically vulnerable populations.

The end of Ivorian cocoa supremacy?

As in many cocoa-producing countries, cocoa farming in Côte d’Ivoire was built on a foundation of deforestation. Since the 1970s, in response to the growing demand for chocolate in Western countries, this phenomenon has intensified. Today, the Ivorian forest reserve is coming to an end. Deforestation, intensive monoculture cultivation without shade and excessive use of pesticides and fertilisers have left a legacy of degraded land and ageing plantations weakened by disease. This situation could suggest that supply from Côte d’Ivoire will stabilise and then decline.

However, it is important to note that some private players in the chocolate sector have taken up this issue and for several years have been leading initiatives to create more sustainable cocoa programs in Côte d’Ivoire. This support is vital if we are to meet the challenges we face and ensure that cocoa production continues over the long term.

Also, diversification of origins seems to be a more favourable way of stabilising the market. Indeed, concentrating production of a raw material in a single geographical area clearly reveals its limits under unfavourable climatic conditions. This leaves an opportunity for other producing countries to respond to market demand. Under what conditions will the supply response take place? Let’s hope it happens in conditions that respect the environment and people.

Faced with climate change, Kaoka provides practical solutions for producer organisations

A COLLECTION OF COCOAS TO MEET THE CLIMATE CHALLENGE

The plantation renovation work undertaken by Kaoka over many years is based on the selection of cocoa varieties. The Kaoka team is present in the field to witness the changes caused by climate change and their impact on cocoa growing. We take this issue seriously, as it could have a major impact on the sustainability of the cocoa program.

With the help of our grower partners, we have built up a collection of around one hundred ‘elite’ cocoa trees. The cocoa trees have been selected for their characteristics: their productive capacity, their resistance to disease and their aromatic potential. Each of these cocoa trees is adapted to one or more specific production zones in our cocoa programs.

In recent years, we have added new criteria to adapt to the problems of certain production areas. We are interested in the cocoa trees that are most resistant to drought. As explained above, many areas are now subject to very hot weather leading to drought, which is unfavourable to the development of cocoa trees and causes yield reductions.

In the face of heavy rainfall, greater resistance to fungal diseases is also a key criterion.

COMBAT DEFORESTATION TO SLOW THE EFFECTS OF CLIMATE CHANGE

We can never say it often enough: the consequences of deforestation have serious repercussions for our environment. Major forest losses are accelerating climate change.

It is vital to put a stop to this phenomenon and to provide serious support to producers in their efforts to make their crops more permanent. This means stopping expansion into forested areas by capitalising on land that is already being farmed. At Kaoka, we provide support to producers to improve soil fertility so that they can continue to grow crops. We provide our grower partners with training in agronomic practices such as pruning and grafting, which are invaluable tools for increasing production on the same plot. We encourage producer organisations to diversify their crops in order to improve the resilience of their farming systems and, consequently, their income.

This transmission of know-how and the involvement of communities are essential to ensure the success of this agricultural revolution.

To complement this approach and to guarantee that our cocoa is not responsible for deforestation, we have put in place a demanding set of standards jointly developed with producer organisations, as well as tools for monitoring landscape changes in our cocoa programs.

A pleasure product, chocolate is not considered to be an essential foodstuff (even if the question deserves to be opened up for debate…) and yet it is omnipresent in our daily lives (biscuits, cereals, pains au chocolat, yoghurt, etc). Without really realising it, chocolate has become deeply rooted in Western culture and associated with many traditions and festivals (Easter, Christmas, Valentine’s Day). In France, for example, we consume an average of over 13 kg of chocolate per household per year.

This crisis could be an opportunity to shine a spotlight on this precious raw material and those who grow it far from the countries that consume the most. Planters, growers, farmers and producers are on the front line when it comes to the effects of climate change. It’s vital that we support them at every level (exporter, processor, wholesaler, distributor, consumer).

Sources

La Story | Pourquoi le cacao flambe – 28 mars 2024

Forestero | Revue hebdomadaire

CIRAD – https://barco.cirad.fr/projet/swollen-shoot

Le Monde | En Côte d’Ivoire, la hausse des cours du cacao ne profite pas aux planteurs – 12 septembre 2023

Le Monde | Cacao en Côte d’Ivoire : face à la flambée des cours, les autorités font un geste en direction des planteurs – 03 avril 2024

World Weather Attribution | Extreme Sahel heatwave that hit highly vulnerable population at the end of Ramadan would not have occurred without climate change – 18 avril 2024

IFPRI | Global cocoa market sees steep price rise amid supply shortfall – 1 avril 2024